Reason for holiday cheer: Today's mortgage rates hold at bargain lows | Dec. 21, 2021

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Credible" below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders, all opinions are our own.

Check out the mortgage rates for Dec. 21, 2021, which are unchanged from yesterday. (iStock)

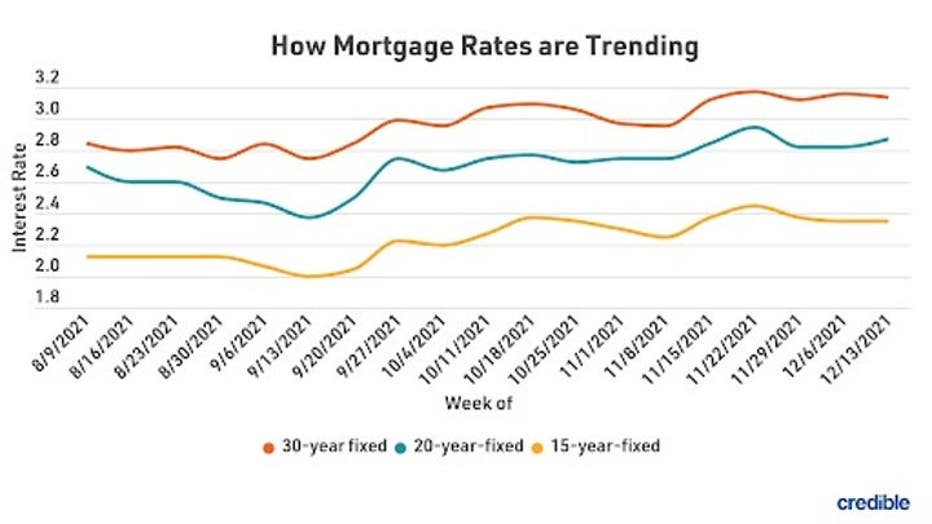

Based on data compiled by Credible, mortgage rates remained unchanged since yesterday.

- 30-year fixed mortgage rates: 3.125%, unchanged

- 20-year fixed mortgage rates: 2.875%, unchanged

- 15-year fixed mortgage rates: 2.250%, unchanged

- 10-year fixed mortgage rates: 2.250%, unchanged

Rates last updated on Dec. 21, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

What this means: With 2022 less than two weeks away, mortgage interest rates have largely settled at bargain lows. But experts predict rates will rise in the new year, so locking in a mortgage rate today could allow buyers to realize significant interest savings. Rates across all repayment terms remain relatively low, but buyers who choose a mid-length rate might find the best deals. Rates for 20-year mortgages have held steady for 10 straight days, and 15-year rates haven’t been lower since October.

These rates are based on the assumptions shown here. Actual rates may vary.

To find the best mortgage rate, start by using Credible, which can show you current mortgage and refinance rates:

Browse rates from multiple lenders so you can make an informed decision about your home loan.

Credible, a personal finance marketplace, has 4,500 Trustpilot reviews with an average star rating of 4.7 (out of a possible 5.0).

Looking at today’s mortgage refinance rates

Mortgage refinance rates remained unmoved today, keeping the savings window open a bit longer for homeowners considering a refinance. But experts widely predict rate increases are coming in 2022. If you’re considering refinancing an existing home, check out what refinance rates look like:

- 30-year fixed-rate refinance: 3.125%, unchanged

- 20-year fixed-rate refinance: 2.875%, unchanged

- 15-year fixed-rate refinance: 2.250%, unchanged

- 10-year fixed-rate refinance: 2.250%, unchanged

Rates last updated on Dec. 21, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

A site like Credible can be a big help when you’re ready to compare mortgage refinance loans. Credible lets you see prequalified rates for conventional mortgages from multiple lenders all within a few minutes. Visit Credible today to get started.

Credible has earned a 4.7-star rating (out of a possible 5.0) on Trustpilot and more than 4,500 reviews from customers who have safely compared prequalified rates.

What to know about locking in a mortgage rate

From the time you begin house-hunting to closing day, your real estate transaction can take months. Mortgage rates can fluctuate from day to day, and vary significantly from month to month.

When you lock in a mortgage rate, your lender commits to giving you that rate at closing, no matter how rates change between the lock date and closing date. Mortgage rate locks typically last from 30 to 60 days, but if you think you’ll need more time, you can negotiate with your lender to extend the lock.

It usually costs nothing to lock in a mortgage rate, although some lenders may charge a fee between .25% and .5% of the total loan amount for a lock longer than 60 days.

You can lock in a mortgage rate at any time during the home buying process. So if you’d rather not home hunt during the holidays, you can still take advantage of today’s low mortgage rates by locking in a rate today and shopping for a home in the new year. Just be sure to get a long enough lock.

Credible can help you compare current rates from multiple mortgage lenders at once in just a few minutes. Are you looking to refinance an existing home? Use Credible’s online tools to compare rates and get prequalified today.

Current mortgage rates

Today’s average mortgage interest rate across all terms is 2.625% for the second straight day — the second-lowest it’s been all month.

Current 30-year mortgage rates

The current interest rate for a 30-year fixed-rate mortgage is 3.125%. This is the same as yesterday. Thirty years is the most common repayment term for mortgages because 30-year mortgages typically give you a lower monthly payment. But they also typically come with higher interest rates, meaning you’ll ultimately pay more in interest over the life of the loan.

Current 20-year mortgage rates

The current interest rate for a 20-year fixed-rate mortgage is 2.875%. This is the same as yesterday. Shortening your repayment term by just 10 years can mean you’ll get a lower interest rate — and pay less in total interest over the life of the loan.

Current 15-year mortgage rates

The current interest rate for a 15-year fixed-rate mortgage is 2.250%. This is the same as yesterday. Fifteen-year mortgages are the second most-common mortgage term. A 15-year mortgage may help you get a lower rate than a 30-year term — and pay less interest over the life of the loan — while keeping monthly payments manageable.

Current 10-year mortgage rates

The current interest rate for a 10-year fixed-rate mortgage is 2.250%. This is the same as yesterday. Although less common than 30-year and 15-year mortgages, a 10-year fixed rate mortgage typically gives you lower interest rates and lifetime interest costs, but a higher monthly mortgage payment.

You can explore your mortgage options in minutes by visiting Credible to compare current rates from various lenders who offer mortgage refinancing as well as home loans. Check out Credible and get prequalified today, and take a look at today’s refinance rates through the link below.

Thousands of Trustpilot reviewers rate Credible "excellent."

Rates last updated on Dec. 21, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

How Credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment, and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

How mortgage rates have changed

Today, mortgage rates are mixed compared to this time last week.

- 30-year fixed mortgage rates: 3.125%, the same as last week

- 20-year fixed mortgage rates: 2.875%, the same as last week

- 15-year fixed mortgage rates: 2.250%, down from 2.375% last week, -0.125

- 10-year fixed mortgage rates: 2.250%, down from 2.375% last week, -0.125

Rates last updated on Dec. 21, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

If you’re trying to find the right rate for your home mortgage or looking to refinance an existing home, consider using Credible. You can use Credible's free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

With more than 4,500 reviews, Credible maintains an "excellent" Trustpilot score.

Fixed vs. adjustable-rate mortgages: How they affect interest costs

Mortgage interest rates can be fixed (meaning they remain the same for the life of your loan) or variable (the rate can change after an initial period). The type of mortgage you choose will affect your interest rate.

Interest rates for fixed-rate mortgages tend to be higher than the initial interest rate for adjustable rate mortgages, or ARMs. But they don’t change, so you’ll know at the beginning of your loan exactly how much interest you’ll pay over the life of your mortgage.

Initial interest rates for ARMs are typically lower than fixed-rate mortgages. But after the end of an introductory period, your interest rate will change — and it could increase significantly. Introductory periods can vary from several months to a year or a few years. After the introductory period, your interest rate will be based on an index your lender specifies. ARMs may or may not cap how much your interest rate can increase.

It’s common for homeowners with adjustable-rate mortgages to refinance into fixed-rate loans when their introductory period is about to end.

Looking to lower your home insurance rate?

A home insurance policy can help cover unexpected costs you may incur during home ownership, such as structural damage and destruction or stolen personal property. Coverage can vary widely among insurers, so it’s wise to shop around and compare policy quotes.

Credible is partnered with a home insurance broker. If you're looking for a better rate on home insurance and are considering switching providers, consider using an online broker. You can compare quotes from top-rated insurance carriers in your area — it's fast, easy, and the whole process can be completed entirely online.

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. He’s been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.