Walz proposes more family tax credits: Here's how much you'd get

Walz proposes more family tax credits: Here's how much you'd get

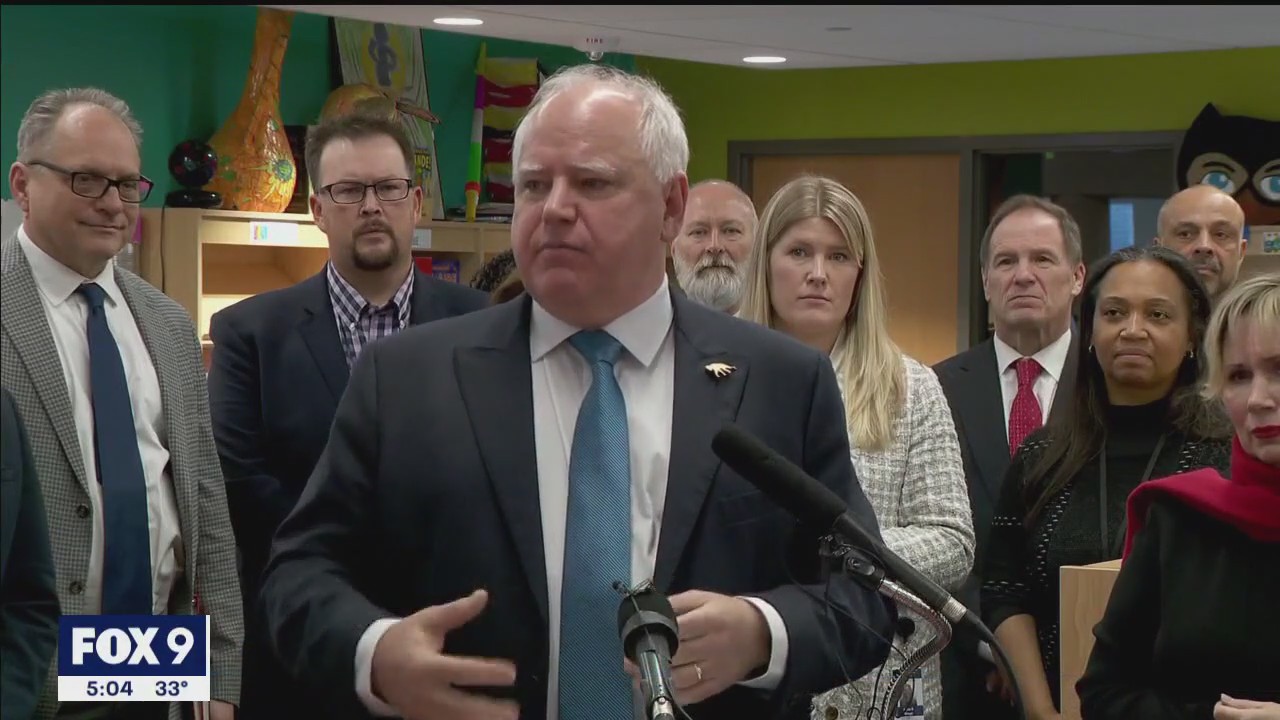

Minnesota Gov. Tim Walz on Tuesday proposed spending nearly one-third of the state's budget surplus to expand family tax credits and boost public school funding.

ST. PAUL, Minn. (FOX 9) - Minnesota Gov. Tim Walz on Tuesday proposed spending nearly one-third of the state's budget surplus to expand family tax credits and boost public school funding.

Walz's proposal uses $5.2 billion of the $17.6 billion projected surplus. It's one element of his overall budget plan that the second-term Democrat intends to release in full next week.

For three tax credits used by Minnesota families, Walz's plan either expands eligibility or makes the credit more lucrative. For public schools, the state's base funding would increase by 4% next school year with additional increases in future years. DFL majorities in the House and Senate generally support the proposals, though they have called for more urgent support to schools this academic year.

"The implementation of this budget will have a profound impact on every single family in the state in a positive way, and it will have a positive impact on every school," Walz told reporters at a St. Paul elementary school.

Tax credits

The proposal includes $1.7 billion in tax credits over the two-year period starting in July. The largest is an expansion of the state's child tax credit, so that families get $1,000 per child under age 18, with a $3,000 maximum. The credit would phase out between $50,000 and $60,000 in household income.

A second credit, for child care and dependent care expenses, would be enhanced. Families would get $4,000 per child under age 5, with a maximum of $10,500, for child care expenses. Older children would qualify for a smaller credit. The benefit phases out between $200,000 and $240,000 in household income.

Another change affects a third tax credit, this one for qualifying K-12 education expenses. The Walz proposal would nearly double the household income limit to $59,000.

The credits are all refundable, meaning families can receive them regardless of how much income tax they owe. Under the governor's plan, people would get this year's tax credits when filing their taxes in spring 2024.

School funding

Walz is proposing a 4% increase in the state's base funding for public schools next year, with a 2% increase the year after. That will cost $717 million over the two-year period, budget officials said.

All students would have access to free breakfast and lunch at school regardless of their family's income. The so-called special education cross subsidy -- the gap between federally mandated spending levels and state funding -- would be cut in half from its current level of $800 million. A smaller gap in English-language programs would be cut by 20%.

Hours before Walz's event, several DFL senators called for fully eliminating the cross subsidies in special education and English learning. The senators also said they would seek $500 million in public school aid for the current academic year.

"It’s more of a relief package than anything else," state Sen. Mary Kunesh, DFL-New Brighton and the Senate Education committee chair, said during a news conference. "When you look at what we have as a surplus and what we have available to it, that’s more or less a drop in the bucket."

When asked about the senators' $500 million proposal, Walz did not say whether he supported it. Instead, he deferred to his education commissioner, who said Walz's plan would give schools the relief they need.

Walz said "we'll see how it plays out" when questioned about why his proposal does not eliminate the special education cross subsidy as both DFL and Republican senators have proposed in the past.

Republicans respond

Republicans questioned several parts of the Walz plan. The GOP favors across-the-board tax cuts instead of credits to certain groups, and Republicans say the increased education spending lacks safeguards to ensure Minnesota's reading and math scores -- which have dipped since before the COVID-19 pandemic -- recover.

"(Walz) is using a lot of talking points," said state Sen. Jason Rarick, R-Brook Park and the top-ranking Republican on the Senate Education committee. "On the surface they sound good, but, honestly, when we look at how we spend money, I don’t think it’s the best way to use the money."

Rarick said he supports full elimination of the special education cross subsidy, which would allow districts to stop pulling funding from their general budgets into special ed.

Republicans also raised eyebrows at another element of Walz's proposal that breaks up the largest state agency, the Department of Human Services, into three. One new agency would focus on children and families, while another would handle DHS's dependent care and treatment functions.

The GOP has advocated for breaking up DHS in the past, when the agency was plagued by scandal in its child care assistance program, but questioned how much more money the two new agencies would require.