Minnesota's marijuana tax revenue surpasses $500K in first month of sales

Recreational marijuana now legal in Minnesota

Recreational marijuana became legal for adults in Minnesota on Aug. 1. FOX 9's Bill Keller shares everything you need to know about the new law.

ST. PAUL, Minn. (FOX 9) - Since legalizing recreational marijuana use among adults over the age of 21, Minnesota has already collected nearly $600,000 in tax revenue from sales in its first month.

A new 10% cannabis tax went into effect on July 1, 2023, for all purchases involving THC, which can also be found in edibles and drinks.

According to the state’s first month of receipts due on Aug. 20, the Minnesota Department of Revenue has received $594,461 from 571 businesses through Aug. 21.

According to the Department of Revenue, the sales tax is projected to provide $15.4 million in additional funding to the state’s General Fund in Fiscal Year 2024. In 2025, the projection rises to $50 million, and in 2026, $84 million is expected.

Located on tribal lands, currently only Red Lake and White Earth Nation have the only legal dispensaries to sell marijuana flower and edibles that contain more than 10 mg of THC per serving in them. On its first day of sales, Native Care in Red Lake saw long lines for its products, and has since expanded hours to Saturday and are establishing a mobile dispensary (similar to a food truck).

Currently, adults can possess and travel within Minnesota's borders with 2 ounces of cannabis flower, 8 grams of concentrate, and 900 milligrams worth of THC-containing edible products (commonly found in gummies and seltzers). Meanwhile, they can have 2 pounds of cannabis flower at home.

However, cannabis products purchased on an Indian reservation from a seller licensed by the tribe are exempt from the specific tax. Sales by or for a patient enrolled in the state’s medical cannabis registry program are also exempt.

Though legal, usage of marijuana is still limited in public places, with both Duluth, Wright County and other communities enacting policies limiting its consumption since legalization.

As part of the new law, 20% of revenues from the gross receipts tax will go to the newly established local government cannabis aid account in a Special Revenue Fund.

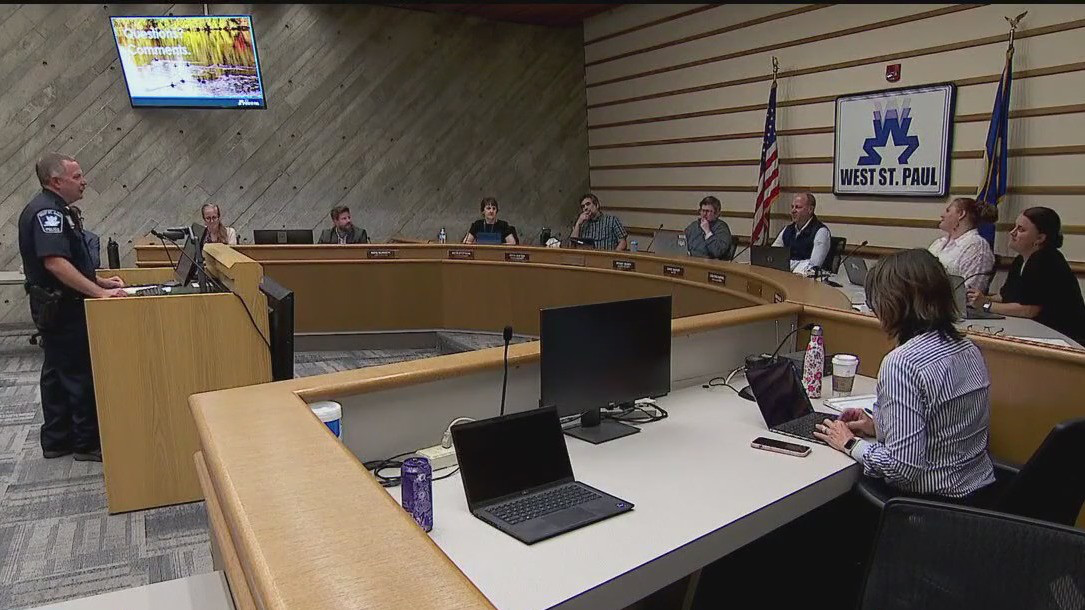

Marijuana: Cities debate public usage policy

As recreational marijuana legalization takes effect Aug. 1, communities around the Twin Cities metro are deciding whether or not to ban public consumption, and how to enforce the policies enacted.