Comparing car insurance quotes can save you hundreds of dollars per year - here's why

Auto insurance premiums vary from one insurer to the next, so it's important to compare rates when you're shopping for a new policy. (iStock)

Car insurance premiums cost an average of $99 per month, according to the most recent data from the National Association of Insurance Commissioners (NAIC). But depending on your coverage, what kind of car you have, how long you've been driving, where you live and other factors, that price can range dramatically.

Prices can also vary greatly from company to company, which is why it's so important to shop around for the best deal on car insurance before you commit to an insurer.

Keep reading to learn why car insurance rates differ so much, and how shopping around can guarantee you a more competitive rate. You can compare quotes from multiple car insurers at once on Credible.

HOW TO CHOOSE THE RIGHT CAR INSURANCE COVERAGE

Auto insurance discounts vary among insurers

Insurance companies offer discounts for drivers who meet certain criteria, and select companies may offer discounts that are more fitting for your needs. These discounts can typically save you between 15% and 20% off the cost of your policy, which can lead to significant savings over time.

Here are some of the most common types of discounts:

- Safe driver discounts: You have a clean driving record if you haven't been in an accident in the past three or five years. Some insurers offer further discounts for drivers who take defensive driving courses.

- Student discounts: Insurers typically offer a discount to college students.

- Safety equipment discounts: Examples of this include air bags, anti-lock breaks, anti-theft systems and daytime running lights.

- Multi-vehicle discounts: This is a type of loyalty discount that helps families save on a policy with multiple cars.

- Military and federal employee discounts: Many insurers offer discounts for military members and other public servants, and some insurers serve these drivers exclusively.

- Bundling discounts: Getting your home and auto insurance through the same provider can save you up to 30% on the cost of your premiums.

Select insurers may offer more significant discounts that are tailored to you. See what kind of auto insurance discounts you qualify for by shopping around on Credible.

HERE’S WHY DRIVERS SHOULD GET COMPREHENSIVE COVERAGE INSURANCE

Insurers weigh factors differently

It's commonly known that your driving history will impact the cost of car insurance. An at-fault accident can raise your insurance premium by 28%, according to PolicyGenius. High-risk motorist behavior like driving under the influence (DUI) or reckless driving will drive up costs even more.

But your driving record isn't the only factor that determines the cost of your policy. Insurers also consider:

- Where you live

- How much you drive

- The type of car you're insuring

- Your age, gender and even marital status

- Your credit score

- Whether you own or rent your home

Each auto insurance company weighs these factors differently, so do your research before you choose an insurer. For example, select companies may offer more a more competitive auto insurance rate for teen drivers, while others are more lenient to drivers with a less-than-stellar driving record.

Researching each auto insurer can take time and effort, but there's a better way. You can compare rates across multiple car insurance policies in just minutes on Credible.

HOW MUCH DOES HOME INSURANCE COST? HERE ARE THE AVERAGE ANNUAL PREMIUMS

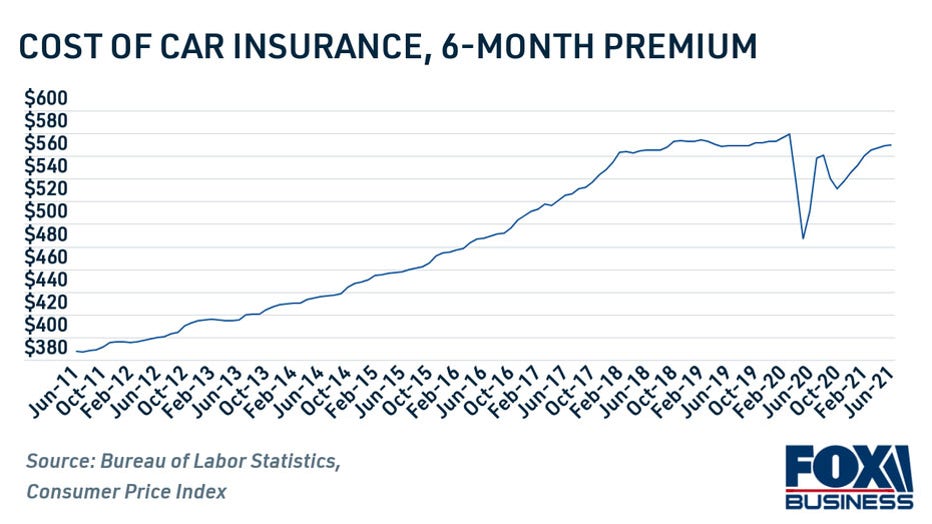

Car insurance premiums tend to rise over time

The cost of auto insurance increased 47% between 2011 and 2021, according to the Bureau of Labor Statistics. Premiums reset once every six months, which is typically when insurers will implement a rate hike.

It's beneficial to shop around and compare car insurance quotes when your premium is about to expire. Ask your current insurer if your premium will rise when you renew, and use that information to see if you're still getting a fair price for your auto insurance policy.

When it's time to renew, you might also consider adding or removing certain coverages from your policy, such as property damage or collision coverage, uninsured motorist coverage and personal injury protection. Full coverage policies tend to be more expensive, but they can save you money in the event of an accident.

If your policy is about to expire, make sure your new rate is competitive by comparing car insurance policies on Credible. Getting an auto insurance quote is free, and it won't affect your credit score.

HOW DO CAR INSURANCE COMPANIES ASSESS DRIVER RISK?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.