8 federally charged in massive Minnesota Housing Stabilization Services fraud scheme

![8 charged in massive MN housing stabilization fraud scheme [FULL]](https://c107833-mcdn.mp.lura.live/expiretime=2082787200/64eb500ad9f816ac0711b89623a9bec6f1ebe527954a152c648352f94b880cbe/iupl/F82/CF7/F82CF774486EFA61E1634C48923024C3.jpg)

8 charged in massive MN housing stabilization fraud scheme [FULL]

Acting U.S. Attorney Joe Thompson announced charges against eight people in a massive housing stabilization fraud scheme in Minnesota. Eight people have been charged with federal crimes for their alleged roles in the scheme. Authorities say this is the first wave of charges.

MINNEAPOLIS (FOX 9) - Federal prosecutors have charged eight people in connection to defrauding millions of dollars from the Minnesota Housing Stabilization Services program.

"The level of fraud in these programs is staggering. Unfortunately, our system of trust but verify no longer works. These programs have been abused over and over to the point where fraud has overtaken the legitimate services," said acting U.S. Attorney Joseph H. Thompson during Thursday's press conference.

8 charged in housing stabilization program fraud

Charges have been filed in the housing stabilization fraud scheme. FOX 9's Mike Manzoni has the latest.

Federal charges

Local perspective:

Eight people have been federally charged with wire fraud for their alleged role in the massive housing stabilization fraud scheme.

The people charged are:

- Moktar Hassan Aden, age 30

- Mustafa Dayib Ali, age 29

- Khalid Ahmed Dayib, age 26

- Abdifitah Mohamud Mohamed, age 27

- Christopher Adesoji Falade, age 62

- Emmanuel Oluwademilade Falade, age 32

- Asad Ahmed Adow, age 26

- Anwar Ahmed Adow, age 25

"The charges filed today represent another big blow to organized program fraud in Minnesota," said Adam Jobes, Special Agent in Charge, IRS Criminal Investigation, Chicago Field Office. "The Minnesota Housing Stabilization Service program was supposed to be a groundbreaking resource to provide stability, assistance, and dignity to seniors and individuals with disabilities. Instead, program funds were diverted to the pockets of greedy opportunists."

Housing Stabilization Services fraud

The backstory:

The Minnesota Housing Stabilization Service program was formed in 2020 to help seniors and people with disabilities, including those with mental illnesses and substance abuse issues, find stable housing.

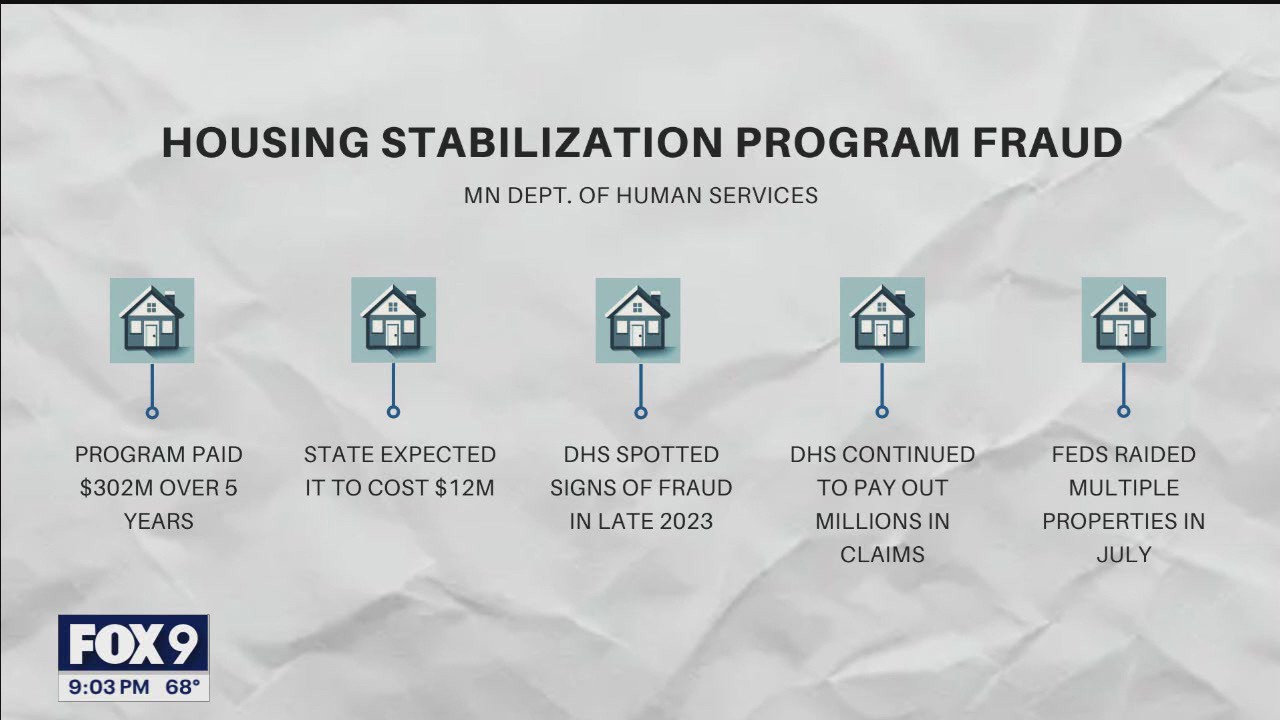

The Medicaid program was estimated to cost about $2.6 million annually, but it quickly grew, and the program paid out a total of $302 million in claims over 4.5 years.

Hundreds of companies enrolled in the program and claimed to provide housing stabilizations services to clients throughout the state. Acting U.S. Attorney Joseph H. Thompson explained that the operators followed a similar scheme by identifying vulnerable people, many of whom were being released from drug or alcohol rehab facilities, and signed them up to receive services. They then submitted inflated and fake reimbursement claims, resulting in substantial pay-outs of taxpayer money.

"Despite the hundreds of millions of dollars in payments that have gone out from the state of Minnesota to housing stabilization services companies, most of these individuals did not receive the stable housing they so desperately needed. The money was just simply stolen," said Thompson.

Thompson said this is only the first wave of defendants charged in the massive scheme. Additional charges are expected as the investigation continues.

Brilliant Minds Services LLC

The defendants, identified as Moktar Aden, Mustafa Ali, Khalid Dayib and Abdifitah Mohamed, allegedly used Aden’s company, Brilliant Minds Services LLC, to submit fraudulent and inflated bills, providing only a faction of the services they claimed.

Brilliant Minds operated out of an office suite in St. Paul, which was in the same building as another provider called Foundation First Services LLC. Mohamed operated First Services and claimed to provide additional reimbursable consultation services to other HSS providers, including Brilliant Minds.

Between September 2022 and April 2025, Brilliant Minds submitted over $2.3 million in fraudulent claims, and ranked as one of the top 10 highest billing HSS providers in the state in 2024, according to the release.

The defendants are accused of diverting taxpayer dollars for personal gain, each pocketing about $300,000 to $400,000 from the company. Additionally, the defendants allegedly shared a credit card, racking up nearly half a million dollars in charges and used the company accounts to pay it off.

Faladcare Inc.

Christopher Falade and his son, Emmanuel, allegedly ran Faldacare Inc. as a provider in the HSS program.

The Falades, and their conspirators, are accused of falsely claiming over $2.2 million in services for about 100 beneficiaries by submitting inflated and fraudulent claims. Prosecutors say a significant portion of the fraudulent funds were funneled to their conspirators and employees.

Leo Human Services LLC

Asad Adow allegedly ran a fraudulent scheme though his company, Leo Human Services, which was based in Brooklyn Park. Adow reportedly instructed his employees to "bill as much as they could" and inflate their billable hours worked, which Adow then submitted for additional fund reimbursement.

Based on the fraudulent and inflated claims, Leo Human Services was paid about $2.7 million for supposedly providing services to about 250 beneficiaries.

Adow allegedly diverted the funds to his brother and employees, in addition to using the money to fund his lifestyle. Prosecutors claim he purchased a BMW, leased an apartment in Roseville, and invested in real estate in Kenya.

Liberty Plus LLC

Anwar Adow, the brother of Asad Adow, owned Liberty Plus LLC, a company based out of Roseville.

Like his brother, Anwar Adow instructed his employees to "bill as much as they could" and incentivized them to inflate their hours worked. Prosecutors say Anwar Adow made more money when his employees overrepresented their billings, and he would submit those billings to the program for reimbursement.

Liberty Plus received more than $1.2 million in Medicaid funds for the alleged services provided to around 200 beneficiaries. Anwar Adow diverted most of the funds to his employees and brother, in addition to leasing a Mercedes-Benz, making investments and using the money to fund his lifestyle, according to the DOJ.

Feeding echoes

Addressing the problem:

Minnesota has cut off funding to the program and helped prosecutors put together criminal cases.

But Thompson says the Feds are generating most of the investigations on their own and a lot of the financial threads tie back to Feeding Our Future.

He says the benefit programs were new, experimental, and vulnerable to being overrun by fraudsters.

"The programs aren't designed to have hundreds or even thousands of bad actors all try to defraud them," he said. "If everyone enrolls a company in the Housing Stabilization Services -- not just 10 or 20 but literally hundreds of them -- and they all enroll essentially at the same time shortly after the program is started and start building in a fraudulent way, it just overwhelms the system. And we've seen that in program after program after a program."

What's next:

Five of the defendants appeared in court Thursday afternoon to plead not guilty to the charges.

One of them — Mustafa Dayib Ali — gave FOX9 a statement Thursday through his defense attorney.

"Mr. Ali is eager to receive the evidence in the case and then work towards showing his innocence in these charges," said Ryan Pacyga. "We anticipate that there’s going to be a lot of work to do given the number of government and private entities that were involved in this case."

All eight of them will eventually get released on bond and with conditions, including that they won’t talk to anyone involved in the HSS programs.

The Source: This story uses information from court documents, the Department of Justice, and a Sept. 18, 2025, press conference.