MNsure misses deadline, 29,000 still waiting for tax form

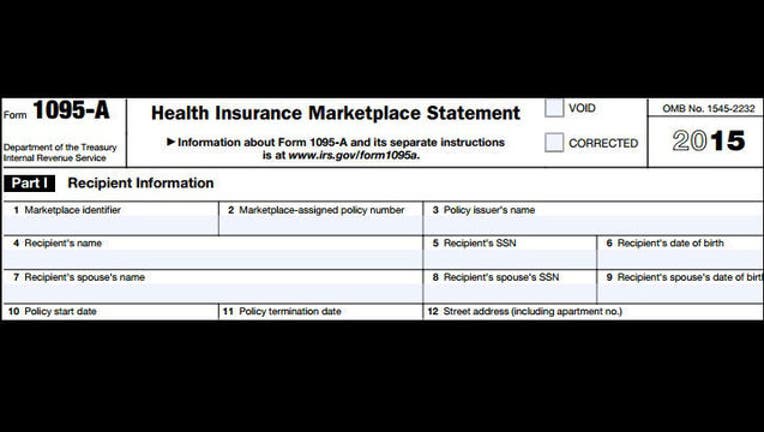

ST. PAUL, Minn. (KMSP) - MNsure missed the Jan. 31 deadline to mail IRS Form 1095-A to a batch of health insurance marketplace enrollees. This statement is the form that shows the IRS you have at least the minimum health insurance required by the Affordable Care Act. The information on the form is also used to calculate the amount of your premium tax credit.

MNsure spokesman Shane Delaney said the agency plans to send about 49,000 forms. About 40 percent of the forms have been mailed so far, leaving about 29,000 that haven't been sent. Delaney said the primary reason for the delay is to ensure accuracy, since the forms that haven’t been sent involve some of the more complicated cases in the MNsure system.

MNsure enrollees with questions can contact the helpline at 1-855-366-7873 (1-855-3MNSURE) from 8 a.m. to 6 p.m. Monday through Friday. MNsure also has an information page for the 1095-A tax form at https://www.mnsure.org/individual-family/cost/1095-A.jsp.

View the IRS information page on health insurance marketplace statements at http://1.usa.gov/1Qf2Mwe.